Step-by-Step Overview to Integrating a 2D Payment Gateway into Your Internet site

Step-by-Step Overview to Integrating a 2D Payment Gateway into Your Internet site

Blog Article

A Comprehensive Overview to the Mechanics and Significance of Using a Payment Portal in Digital Transactions

In today's increasingly digital marketplace, recognizing the technicians and importance of payment entrances is extremely important for any type of business took part in on the internet deals. These vital systems not just assist in safe and secure economic exchanges yet likewise play an essential role in enhancing client confidence and enhancing the transaction process. As we discover the different aspects of repayment gateways, from their core functions to the important attributes that differentiate one from another, it ends up being obvious that a nuanced comprehension can substantially influence a firm's operational efficiency and customer contentment. What particular elements should services prioritize to guarantee ideal performance?

What Is a Settlement Gateway?

A repayment gateway is a modern technology that assists in the transfer of settlement info in between a client and a vendor's bank. It works as an intermediary, making sure that delicate monetary information is firmly sent throughout on-line transactions. By securing the consumer's repayment details, the gateway secures against fraud and unapproved accessibility, which is vital in preserving consumer depend on in electronic commerce.

Repayment portals support numerous payment approaches, consisting of charge card, debit cards, and electronic budgets, making them important for businesses looking for to accommodate diverse customer choices. They are typically integrated right into ecommerce platforms, allowing for smooth check out experiences. In addition, repayment entrances offer functions such as deal tracking, reporting, and settlement monitoring, which aid businesses in checking their financial performance.

The function of repayment gateways extends past plain purchase handling; they additionally add to conformity with industry requirements, such as the Repayment Card Sector Information Security Requirement (PCI DSS) This conformity is vital for securing client information and minimizing obligation risks for vendors. In summary, a repayment gateway is an important element of contemporary shopping, enabling effective and safe transactions while improving the total consumer experience.

Just How Payment Gateways Job

The capability of repayment entrances rests on a series of interconnected processes that make sure secure and efficient purchase implementation. When a client initiates an acquisition, the settlement portal encrypts the purchase data to protect sensitive details, such as bank card information. This encryption converts the data right into a safe and secure format, making it unreadable to unapproved parties.

As soon as the information is secured, it is transmitted to the obtaining bank or settlement cpu, who checks the legitimacy of the transaction. This involves confirming the customer's settlement details and ensuring there suffice funds in the account. The obtaining financial institution after that interacts with the issuing bank, which is the bank that issued the consumer's card, to accredit the purchase.

Upon obtaining the authorization, the releasing financial institution sends a response back via the repayment entrance, indicating whether the deal is approved or decreased. If approved, the payment gateway finishes the transaction by notifying the vendor and facilitating the transfer of funds from the customer's account to the merchant's account. This entire process commonly takes place within seconds, providing a seamless experience for both the consumer and the vendor.

Secret Attributes of Repayment Entrances

While countless payment entrances exist, particular crucial features differentiate them and improve their capability for both sellers and consumers. Safety and security is critical; top-tier settlement entrances use innovative encryption strategies and compliance with Settlement Card Market Read Full Report Data Safety And Security Specifications (PCI DSS) to protect sensitive deal information. This shields both the vendor's and customer's monetary details from fraudulence and violations.

One more important function is the ability to support numerous settlement approaches. A flexible payment gateway should help with numerous transaction types, including credit score and debit cards, e-wallets, and bank transfers, dealing with diverse client choices. Furthermore, seamless combination with existing e-commerce systems and buying carts is important, allowing sellers to incorporate payment processing without considerable technological difficulties.

Individual experience is also crucial; reliable payment gateways supply a smooth and intuitive user interface, reducing cart desertion prices. Real-time processing capacities make sure quick transaction verifications, improving client satisfaction. Furthermore, in-depth coverage and analytics tools enable vendors to image source track sales, monitor performance, and make notified organization decisions. These key attributes collectively encourage companies to operate properly in an affordable electronic market while giving a hassle-free and protected experience for customers.

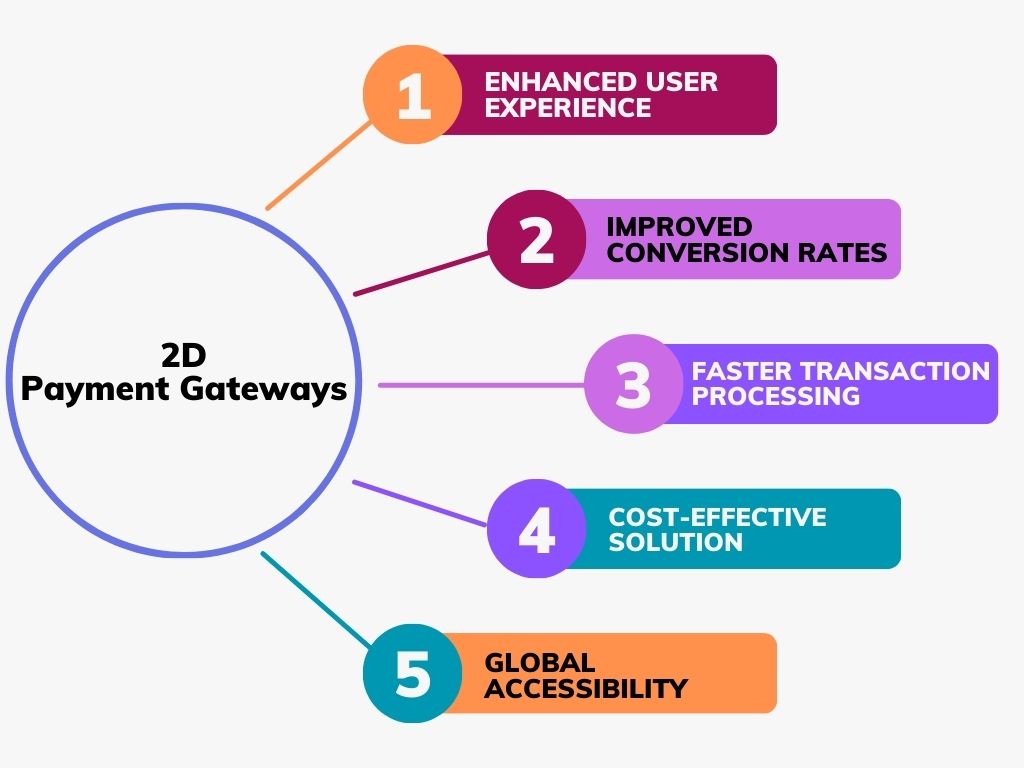

Advantages of Utilizing Repayment Gateways

Utilizing repayment portals provides countless benefits for organizations seeking to improve their online transaction processes. One of the primary benefits is safety and security; payment portals utilize sophisticated encryption technologies to shield sensitive consumer information, reducing the danger of fraudulence and information breaches. This improved security not just safeguards consumer data but likewise promotes depend on, motivating repeat organization.

Additionally, settlement gateways enhance the deal process, enabling quicker and more efficient repayments. This performance can lead to enhanced cash flow, as deals are processed in real-time, facilitating quicker access to funds. In addition, they support multiple settlement techniques, including bank card, debit cards, and electronic wallets, catering to a more comprehensive consumer base.

One more considerable benefit is the ability to incorporate repayment gateways with existing shopping systems and bookkeeping systems. This combination streamlines financial monitoring and coverage, enabling organizations to concentrate on development rather than management jobs. Several repayment entrances use analytics and reporting tools, offering useful understandings into consumer habits and transaction trends, which can inform advertising approaches and enhance overall business performance. In summary, payment entrances are important for organizations intending to maximize their digital transaction landscape - 2D Payment Gateway.

Picking the Right Payment Portal

Picking the best settlement portal is important for organizations intending to maximize their online transaction procedures. The selection of a repayment entrance effects not just the consumer experience yet additionally the total efficiency and safety web and security of deals.

When reviewing potential portals, services ought to think about numerous vital factors. Analyze the fees linked with each entrance, consisting of transaction costs, regular monthly charges, and any type of concealed expenses, as these can dramatically affect revenue margins. Next off, examine the entrance's integration capacities with existing e-commerce platforms or software program, making certain a seamless connection that minimizes disruptions.

Security is another essential element; appearance for gateways that abide with PCI DSS requirements and provide sophisticated fraud detection tools. Furthermore, take into consideration the series of settlement alternatives sustained, as a varied option can enhance customer fulfillment and conversion prices.

Final Thought

Finally, repayment portals offer a vital feature in the world of electronic transactions by making certain protected, reliable handling of payments. Their ability to encrypt delicate data and assistance numerous repayment approaches enhances consumer trust fund and contentment. The calculated option of a payment gateway customized to particular organization requirements can substantially improve monetary monitoring and operational performance. Comprehending the technicians and advantages of settlement portals is vital for businesses aiming to flourish in the competitive on the internet marketplace - 2D Payment Gateway.

Additionally, repayment portals use functions such as deal tracking, reporting, and settlement management, which help businesses in monitoring their economic performance.

The role of repayment entrances expands beyond simple deal processing; they additionally add to conformity with industry criteria, such as the Settlement Card Sector Information Protection Requirement (PCI DSS) Safety is extremely important; top-tier payment entrances employ advanced encryption techniques and compliance with Settlement Card Industry Data Safety And Security Specifications (PCI DSS) to guard delicate purchase information.Additionally, repayment portals improve the purchase procedure, allowing for quicker and much more reliable settlements.In final thought, settlement gateways offer an important function in the world of digital purchases by making certain secure, efficient processing of payments.

Report this page